Age of Homebuyers Skyrockets

David Deem

714-997-3486

By Jessica Lautz, VP, Demographics & Behavioral Insights, National Association of REALTORS®

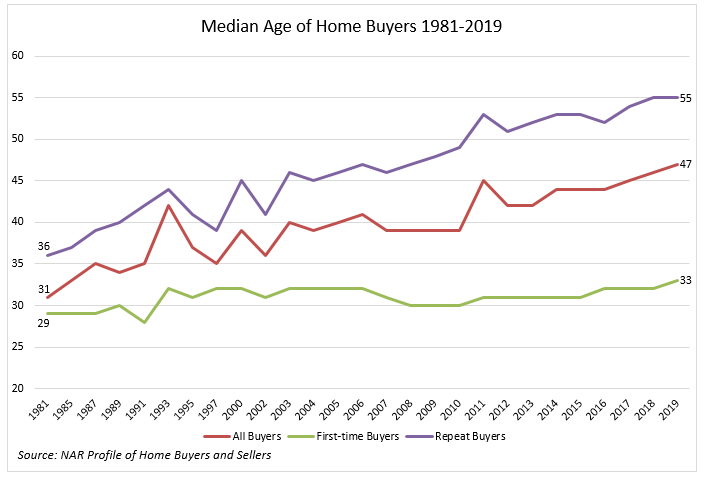

One of the more fascinating trends from the recent 2019 Profile of Home Buyers and Sellers is the rising age of homebuyers. Overall, buyers’ ages have jumped from a median of 31 in 1981 to 47 in 2019. While many attribute that increase to the rising age of first-time buyers, there’s more to the story.

From 1981 to 2018, the median first-time buyer age was actually a pretty boring, flat line that fluctuated between 28 and 32. In 2019, it increased slightly to the median age of 33. It’s not a huge change but enough to know there are other factors at play. First-time buyers face a number of hurdles to entering homeownership. Many have difficulty saving for a down payment as a result of rising home prices, rising rental costs, and getting their debt-to-income ratio in check while tackling student loan debt. First-time buyers also face a housing desert with the lack of affordable, entry-level properties. Those who do enter the market often overcome these hurdles with family help, such as down-payment assistance, or the ability to move directly from a parent’s home into homeownership.

The number that has changed dramatically since 1981 is the rise in the age of repeat buyers. Repeat buyers were a median age of 36 in 1981 and are now at 55. The incremental climb over the last 38 years can be attributed to a number of factors. Many owners are staying in their homes for longer periods of time—either because they want to or because they had to as their home was worth less than their mortgage after the Great Recession. Tenure in a home is now at 10 years, up from six to seven years. Americans are also living and working longer, so the idea of moving and purchasing a new home, even with a mortgage, is a trend many feel comfortable doing past the traditional retirement age. And because Americans are having children later in life, many life decisions get pushed further into the future. Working and assisting a grown child through college and beyond now takes precedence over downsizing. Many parents are holding onto their family home as adult children boomerang back after college.

Today, because of steady home-price increases, many homeowners are in a positive home equity situation, and they are making the move to a home that fits their family’s needs better. Some are moving to be closer to friends and family, others to a larger home, and some just to a better area. Sellers who were holding back are now finally ready to break and make that move. Repeat buyers are able to lock in the same low interest rates they likely have on their existing home—another factor that may have delayed their move in the past. What is of note among homebuyers who are a median age of 55: They plan to stay in their homes for 15 to 20 years, and many never plan to move. It’ll be interesting to see whether that mindset holds true in practice.

DRE #01266522

Comments

Post a Comment